There is a lot of talk about the stock market, and one term you may have heard is "averaging." What does this mean, and what impact does it have on your investments? This article will discuss averaging in the stock market and how it can affect your portfolio. We will also provide some tips on how to use averaging to your advantage when investing in stocks.

What Is Averaging?

Averaging is a way of buying stocks at different prices in order to reduce the risk associated with investing. Generally, you pay one price for each share when you buy stocks. With averaging, however, you buy multiple shares at different prices over time. By doing this, your average cost per share will be lower than if you had bought all the shares at once.

How Does Averaging Work?

When you buy stocks through averaging, you are essentially diversifying your investments. Instead of purchasing one large block of shares all at once, you are buying smaller blocks over time in order to spread out the risk. This means that if the stock price goes down after you buy one batch of shares, you may still be able to purchase more at a lower price. Ultimately, this can reduce your average cost per share.

How Can Averaging Help in the Stock Market?

Averaging is an effective strategy for reducing risk when investing in stocks. By buying smaller blocks of shares over time and at varying prices, you can spread out the risk associated with investing. This also allows you to take advantage of price fluctuations in order to obtain a lower average cost per share. Another benefit of averaging is that it can help you stay disciplined with your investments. By committing to buying shares on a regular basis, regardless of whether the stock prices go up or down, you can ensure that you are investing consistently. In the long run, this could help you build a more diversified portfolio and manage risk better.

What Is Averaging Up In Stocks?

Averaging up is a strategy that some investors use to take advantage of price fluctuations. With this technique, you purchase additional shares at lower prices in order to bring down your average cost per share. This can help offset losses if the stock price falls after you have bought initial batches of shares. When using averaging in your investment strategy, there are a few key things to keep in mind. First, it’s important to stay disciplined and purchase shares on a regular basis. This will help you spread out the risk associated with investing and ensure that you are taking advantage of price fluctuations. Second, it’s important to monitor the stock market and be mindful of price changes. By doing this, you can determine when it is best to buy or sell stocks in order to maximize your returns. Overall, averaging is a great way to reduce risk and stay disciplined with your investments. By purchasing shares at different prices over time, you can ensure that you are taking advantage of price fluctuations and diversifying your portfolio. By utilizing this strategy, you can take the guesswork out of investing and achieve greater success in the stock market.

When Is Averaging Down a Good Idea?

Averaging down can be a good idea if you believe that the stock is likely to increase in value over time. This allows you to purchase more shares at a lower price and benefit from any gains that may occur as the stock price rises. However, this strategy should only be used when there are strong fundamental reasons for believing that the stock will go up in the future.

Tips for reducing risk when averaging up in stocks?

1. Monitor the stock market regularly and be mindful of any price changes. This will help you determine when it is best to buy or sell stocks in order to maximize your returns.2. Consider buying shares at different prices over time and spreading out the risk associated with investing.

3. Be sure to only invest what you can afford to lose, as there are no guarantees of success in the stock market.

4. Research the company in which you would like to invest and make sure that their fundamentals are sound.

5. Consider using a stop-loss order to limit your losses if the stock price falls unexpectedly.

6. Utilize averaging only when you have strong fundamental reasons for believing that the stock will increase in value over time.

7. Diversify your portfolio and invest in different stocks, sectors, and countries to spread out the risk even further.

8. Consider consulting with a financial advisor or professional who can help guide you through the process of investing in stocks.

9. Keep your emotions in check and avoid making decisions based on fear or greed.

By following these tips, you can reduce the risk associated with averaging up in stocks and give yourself the best chance of success. With a disciplined approach to investing, you can ensure that you are taking advantage of price fluctuations while minimizing losses in the long run.

Why averaging up can be a successful strategy?

Averaging up can be a successful strategy because it allows you to purchase additional shares at lower prices and benefit from any gains that may occur as the stock price rises. Additionally, this strategy helps to reduce risk by spreading out your investments over time. When used in conjunction with other measures, such as diversifying one's portfolio or setting stop-loss orders, averaging up can be a great way to reduce the risk associated with investing in stocks. As with any investment strategy, it is important to research the company and consult a financial advisor before making any decisions. Averaging is a powerful tool for reducing risk when investing in stocks. By buying shares at different prices over time, you can spread out your investments and lower your average cost per share. This can help you manage risk better and stay disciplined in your investing approach. However, it is important to remember that no investment strategy, including averaging, guarantees success. Before making any investments, be sure to do your research and understand the risks associated with each stock. With the right knowledge and strategy, averaging can be a great way to invest in the stock market.

What Is Stock Average Calculator ?

Stock Average calculator is application which is used to calculate the average price of the Stocks of shares.when we buy number of stocks on different prices then we need to calculate the exact Average price of the Stocks or share.Many Investor or retailer always try to buy Stocks at lower price than before they bought.Many investor Average down their position by buying the same stock again at lower Prices.

How To Used Stocks Average Calculator

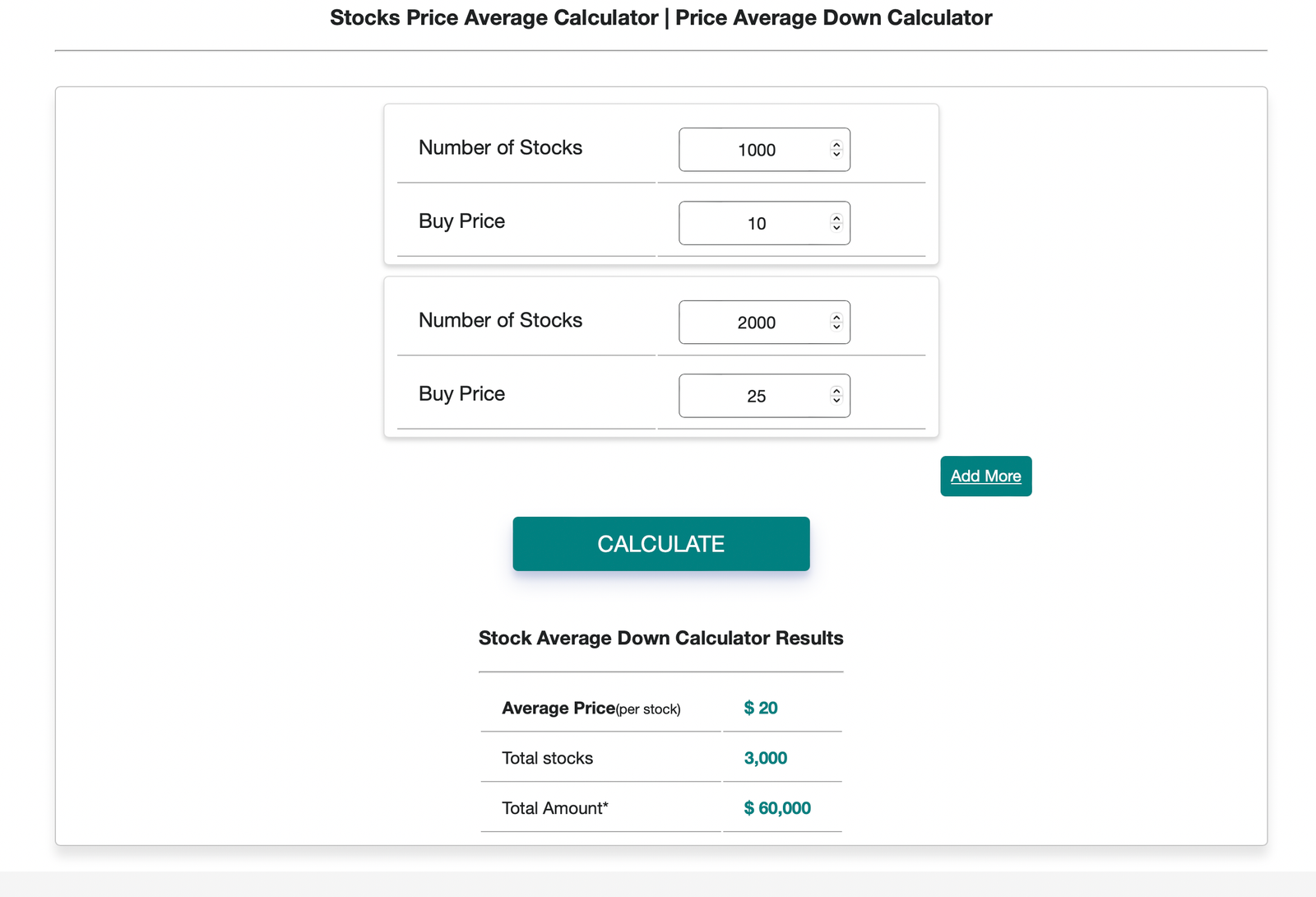

Stocks Average Calculator is a tool used for Average down the position of stocks.For this

you have to enter the share price and Number of Units

1:- Enter the Purchased price and Number of Units

2:-Click on Calculate Button to get the average price of Stocks

3:- By Clicking Add more button you can add more stocks to average down the prices

of the stocks

4:- By Clicking the Close button you can Removed the Stocks

How Stocks Average Calculator Works ?

Stocks Average Calculator Basically works on Mathematical Average method.It first Compute

the total purchased price then it Devide by total number of Shares unit.

1. Total purchase price = Σ(Price of stock * Number of shares)

2. Total shares = Σ(Number of shares)

3. Stock Average price = Total purchase price / Total shares

How to calculate the average stock price?

For example, if you bought 1000 stocks of company x at the Price of $10 per stock and again bought 2000 stocks

at price of $25 per stock.

In this 1st case,Total purchased price is 1000 multiplied by $10 i.e 1000*$10 and get $10000;

In the 2nd case, 2000 multiplied by $25 i.e 2000*$25 and get $50000

So the total purchased price is $10000+$50000.

Divide this by Total no. of share units i.e $60000 / 3000 = $20

so the Average stock price is $20.

Stock Average Formula:

Step 1 = Number of Shares * Purchase Price

Step 2 = Sum of all Shares Bought

Step 3 = Step 1 / Step 2

Why Stock Average calculator needed ?

Stock Average calculator is application which is used to calculate the average price of the Stocks of shares.when we buy number of stocks on different prices then we need to calculate the exact Average price of the Stocks or share.Many Investor or retailer always try to buy Stocks at lower price than before they bought.Many investor Average down their position by buying the same stock again at lower Prices.now We know what is averaging is and how averaging works. generally investors do averaging when the price of a stock starts to fall. We have three options in a falling stock market, first is to sell the stock at below buying price and making a loss. The second is to wait until the price increases above bought price and ignore the current conditions; the third is to see this as an opportunity and buy more company stocks at lower prices. The third step is what we call averaging; whenever the word averaging is used in the article, it means the case of averaging down. Averaging in the stock market is a procedure to buy more shares of a same company as its price falls, which can give the lower overall average buy price. Buying company stock at dips and adding to a position when the price falls can be profitable in a bull market but can increase losses in downtrends.

Frequently asked questions

What Is Averaging?

Averaging is a way of buying stocks at different prices in order to reduce the risk associated with investing. Generally, you pay one price for each share when you buy stocks. With averaging, however, you buy multiple shares at different prices over time. By doing this, your average cost per share will be lower than if you had bought all the shares at once.

What Is Stock Average Calculator ?

Stock Average calculator is application which is used to calculate the average price of the Stocks of shares.when we buy number of stocks on different prices then we need to calculate the exact Average price of the Stocks or share.Many Investor or retailer always try to buy Stocks at lower price than before they bought.Many investor Average down their position by buying the same stock again at lower Prices.

Stock Average Formula:

Step 1 = Number of Shares * Purchase Price

Step 2 = Sum of all Shares Bought

Step 3 = Step 1 / Step 2

How Stocks Average Calculator Works ?

Stocks Average Calculator Basically works on Mathematical Average method.It first Compute

the total purchased price then it Devide by total number of Shares unit.

1. Total purchase price = Σ(Price of stock * Number of shares)

2. Total shares = Σ(Number of shares)

3. Stock Average price = Total purchase price / Total shares